south carolina inheritance tax 2019

Has the highest exemption level at 568 million. While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due.

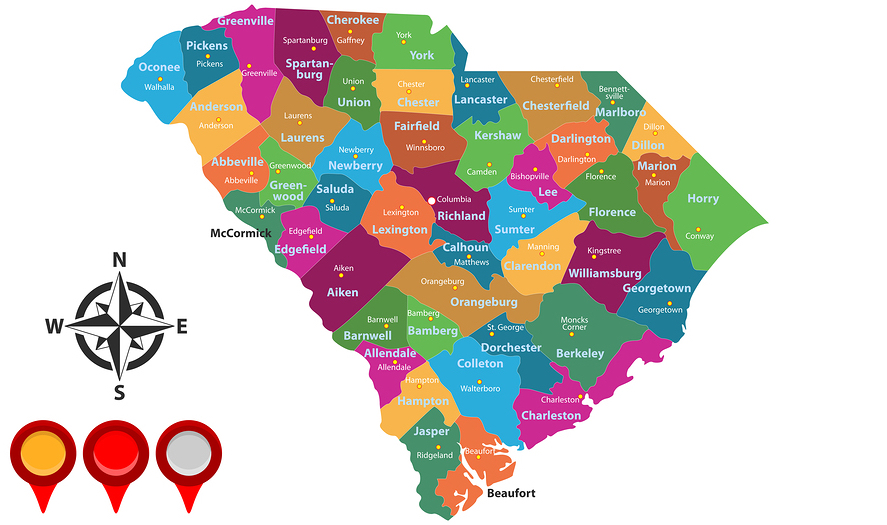

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local

Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax.

. Has the highest exemption level at 568 million. What are the estate taxes in South Carolina. It is one of the 38 states that.

As well as how to collect life insurance pay on death. Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax. South carolina does not levy an estate or inheritance tax.

South Carolina Inheritance Tax 2019. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

South Carolina has no estate tax for decedents dying on or after January 1 2005. No estate tax or inheritance tax. No estate tax or inheritance tax.

As well as how to collect life insurance pay on death. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. 7 TAX on Lump Sum Distribution attach SC4972.

South Carolina Inheritance Law. 8 00 9 TAX on excess withdrawals from Catastrophe Savings. South Carolina does not levy an estate or inheritance tax.

Ad Holistic approaches to wealth management including financial planning and goal setting. The effective state and local tax rate for south carolina residents in 2019 was 89 percent the 11th lowest percentage among the 50. 7 00 8 TAX on Active Trade or Business Income attach I-335.

Unlike some other states there are no. Of the six states with inheritance taxes Nebraska has. South Carolina Inheritance Law.

Regular citizens must pay the standard inheritance tax rate of 40 on any part of an estate thats valued above a threshold of 325000 pounds about 374000. This doesnt eliminate other expenses related to estate planning expenses such as inheritance tax that. South Carolina taxable income of estates and trusts is taxed either to the fiduciary or to the beneficiaries in the same manner as federal Income Tax purposes.

Mercer Advisors is a full service wealth management firm with over 30 years of experience. In January 2013 Congress set the estate tax exemption at 5000000. Massachusetts has the lowest exemption level at 1 million and DC.

In case you inherit a property from a. Federal exemption for deaths on or after January 1 2023.

The True Cost Of Living In South Carolina

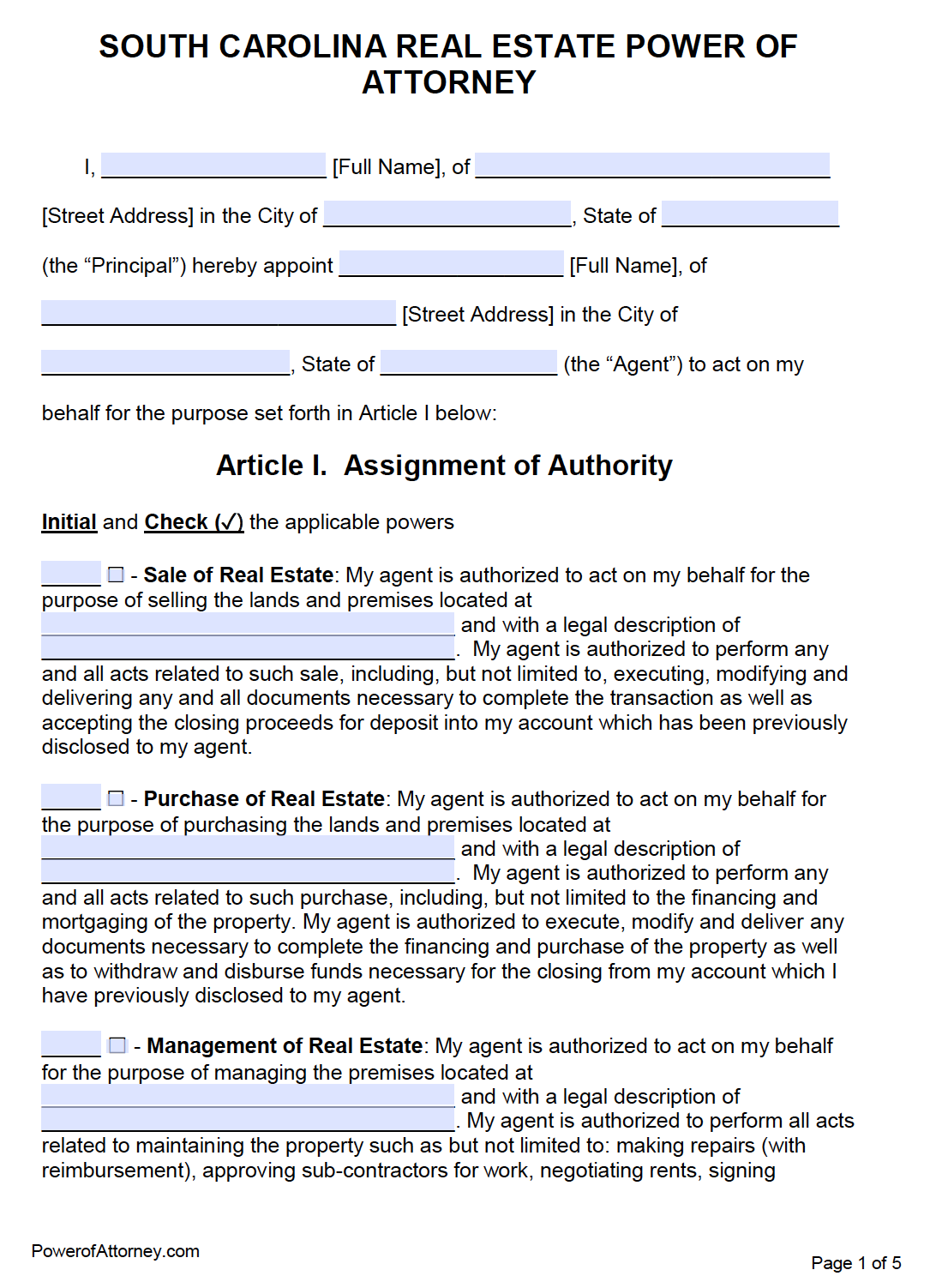

Free Real Estate Power Of Attorney South Carolina Form Pdf Word

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

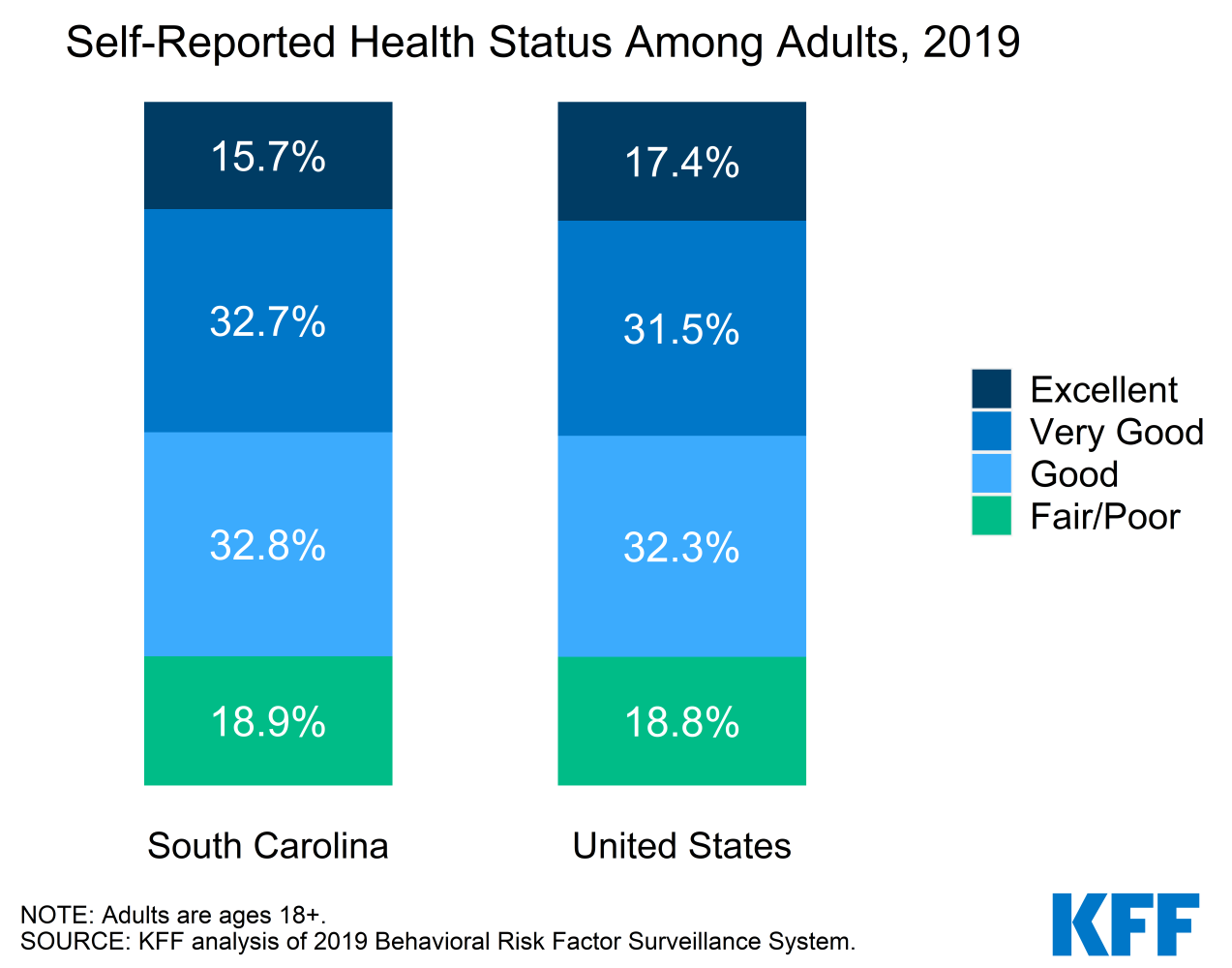

Election 2020 State Health Care Snapshots South Carolina Kff

2022 Top 25 Best Places To Live In South Carolina

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Does South Carolina Require Inheritance Tax King Law

Ultimate Guide To Understanding South Carolina Property Taxes

12 Best Places To Live In South Carolina

South Carolina Covid 19 Resources Sc Office Of The State Treasurer

Home Abbeville County South Carolina

Home South Carolina Community Loan Fund

South Carolina Property Tax Rate Guide Easyknock

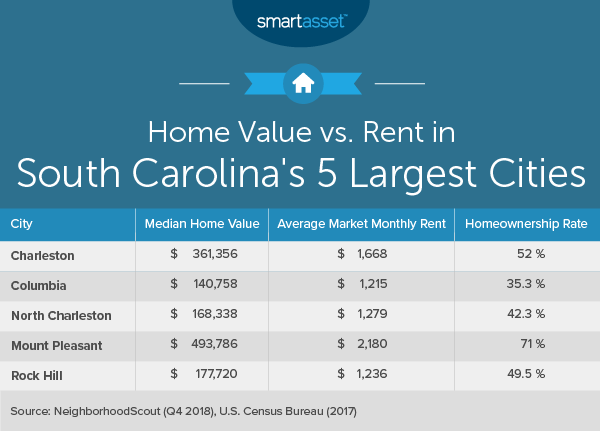

Cost Of Living In South Carolina Smartasset

Creating Racially And Economically Equitable Tax Policy In The South Itep